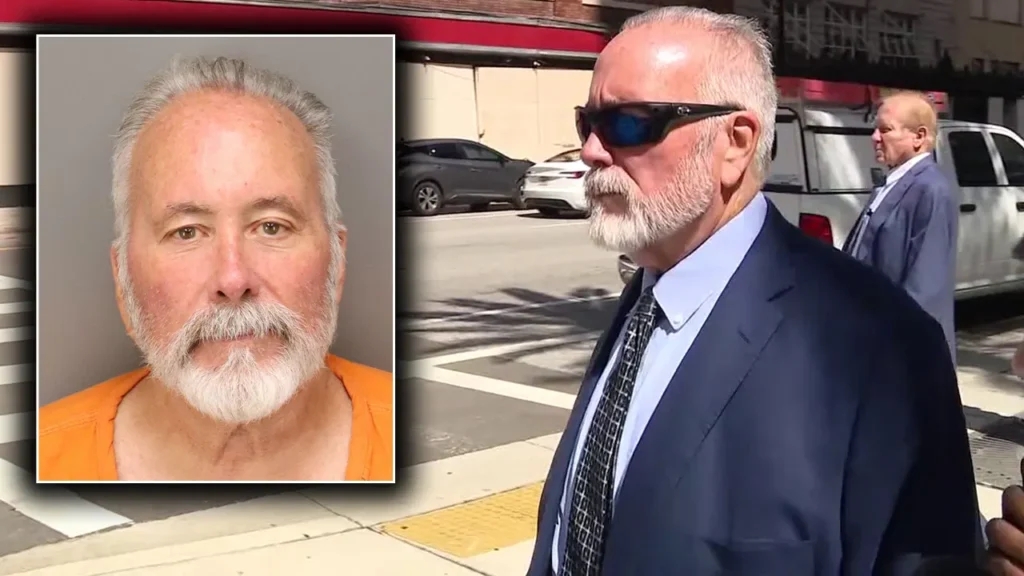

Florida Nonprofit Founder and Accountant Charged with Stealing Over $100M from Special Needs Victims

On June 23rd, 2025 two Florida men: Leo Govoni and John Leo Witeck – were officially charged by the U.S. Department of Justice for allegedly employing a fraudulent scheme to steal over $100 million from a nonprofit organization that managed funds for people with special needs and disabilities, the department said.

Leo Joseph Govoni and John Leo Witeck,were charged in a newly unsealed indictment for allegedly orchestrating a massive fraud scheme that stole over $100 million from a nonprofit, the Center for Special Needs Trust Administration (CSNT), which managed funds for individuals with disabilities and special needs.

Key details from the indictment:

- Role and Organization: Leo Joseph Govoni co-founded CSNT around 2000, and John Leo Witeck worked as an accountant there. The nonprofit managed trust funds for people with disabilities, including court settlements and other payments, serving beneficiaries in nearly every state. As of February 2024, CSNT managed approximately 2,100 trusts with an estimated $200 million.

- Alleged Conduct: From June 2009 through May 2025 (as stated in the indictment), Govoni, Witeck, and others are accused of stealing, misappropriating, and soliciting funds meant for CSNT beneficiaries, using sophisticated deception such as fraudulent account statements showing false balances. The stolen money was allegedly used for luxury items like real estate, private jet travel, a brewery, and personal expenses.

- Concealment and Disguising Activities: The defendants reportedly concealed their activities through complex financial transactions and deceit. When CSNT filed for bankruptcy in 2024, they revealed over $100 million missing from client accounts. Govoni is also charged with making false declarations during these bankruptcy proceedings.

- Additional Charges: Govoni allegedly committed bank fraud related to a $3 million mortgage refinance and laundered over $205,000 to pay off his home equity line of credit.

- Charges and Penalties: Both men face charges of conspiracy to commit wire/mail fraud, wire fraud, mail fraud, and conspiracy to commit money laundering (all carrying a maximum penalty of 20 years per count). Govoni faces additional charges: bank fraud (up to 30 years), illegal monetary transactions (up to 10 years), and false bankruptcy declarations (up to 5 years).

- Investigations and Prosecution: The FBI, IRS-CI, HHS-OIG, and SSA-OIG are investigating. The prosecution is being handled by Trial Attorney Lyndie Freeman and Assistant U.S. Attorneys Jennifer Peresie and Michael Gordon.

Center for Special Needs Trust Administration (CSNT)

Leo Joseph Govoni allegedly used stolen funds from special needs trust clients to buy real estate, travel by private jet, finance a brewery, deposit large sums into his personal bank accounts, and pay off personal debts. He is also accused of committing bank fraud connected to a $3 million mortgage refinance loan.

Both Govoni and John Leo Witeck are charged with conspiracy to commit wire and mail fraud, wire fraud, mail fraud, and conspiracy to commit money laundering. If convicted on these charges, each faces up to 20 years in prison per count. Govoni has additional charges: bank fraud, illegal monetary transactions, and false bankruptcy declarations, carrying a potential maximum of 45 years in prison if convicted for all these additional counts.

Matthew R. Galeotti, Head of the Justice Department’s Criminal Division, stated: “As alleged, for over 15 years, the defendants conspired to use the funds of special needs clients as a personal piggy bank, stealing $100 million dollars meant for the most vulnerable members of our society to enrich themselves. Today’s charges reflect the Criminal Division’s ongoing commitment to prosecuting sophisticated fraudsters who abuse the trust of their victims”.

I get a letter in the mail saying the account has been depleted,” said Louis Capasso, Elena’s dad. “There’s nothing left in there.”

Capasso said his daughter Elena, who has downs syndrome, had $250,000 in a trust account managed by the Center for Special Needs Trust Administration. Every penny he says is gone.

“They don’t see you getting the money back they said,” said Capasso.

His case is far from the only one. According to the centers Chapter 11 bankruptcy filing, we’ve discovered there could be as many as 1,000 people who are missing some or all of their trust money. Investigator Brittany Muller went to speak to the non-profits’ spokesperson, Beth Leythem.

“When something had happened how much money was missing?”

“The amount that we know right now is $100 million,” Leytham said.

“They begin pulling on threads while they still managed the trust fund trying to figure out what it happened here, where has this money gone?” Leytham said.“They contacted the law firms and said we haven’t been able to figure this out internally, we would like you to help us figure it out,” she said.

“He didn’t even care it was kids that he was stealing from,” Capasso said. “That’s what makes it so bad.”

“I would tell them that we are doing everything we possibly can to get that money back where it belongs with them,” Leytham said. “Every legal remedy available to us we are accessing it we are pursuing it.”